Protecting Assets Alzheimer’s: 7 Powerful Steps for 2025 Success

The Critical Importance of Protecting Assets with Alzheimer’s

When a loved one receives an Alzheimer’s diagnosis, families face not just emotional challenges, but financial ones too. The window for protecting assets alzheimer’s begins to close from that moment forward.

I’ve seen this scenario hundreds of times in my 25 years as an attorney. The early signs often appear in everyday money matters – unopened bills piling up, confusion when counting change, unusual purchases, or forgotten financial transactions. These aren’t just inconveniences; they’re warning bells that require immediate action.

The reality is sobering. Alzheimer’s care typically costs over $400,000 over a lifetime, with patients often living 10-15 years after diagnosis. Without proper planning, these expenses can devastate a family’s financial security and eliminate any legacy for future generations.

The greatest challenge is timing. Legal protections must be put in place while your loved one still maintains the mental capacity to sign documents and make decisions. Wait too long, and you’ll likely face expensive, time-consuming court proceedings for guardianship or conservatorship.

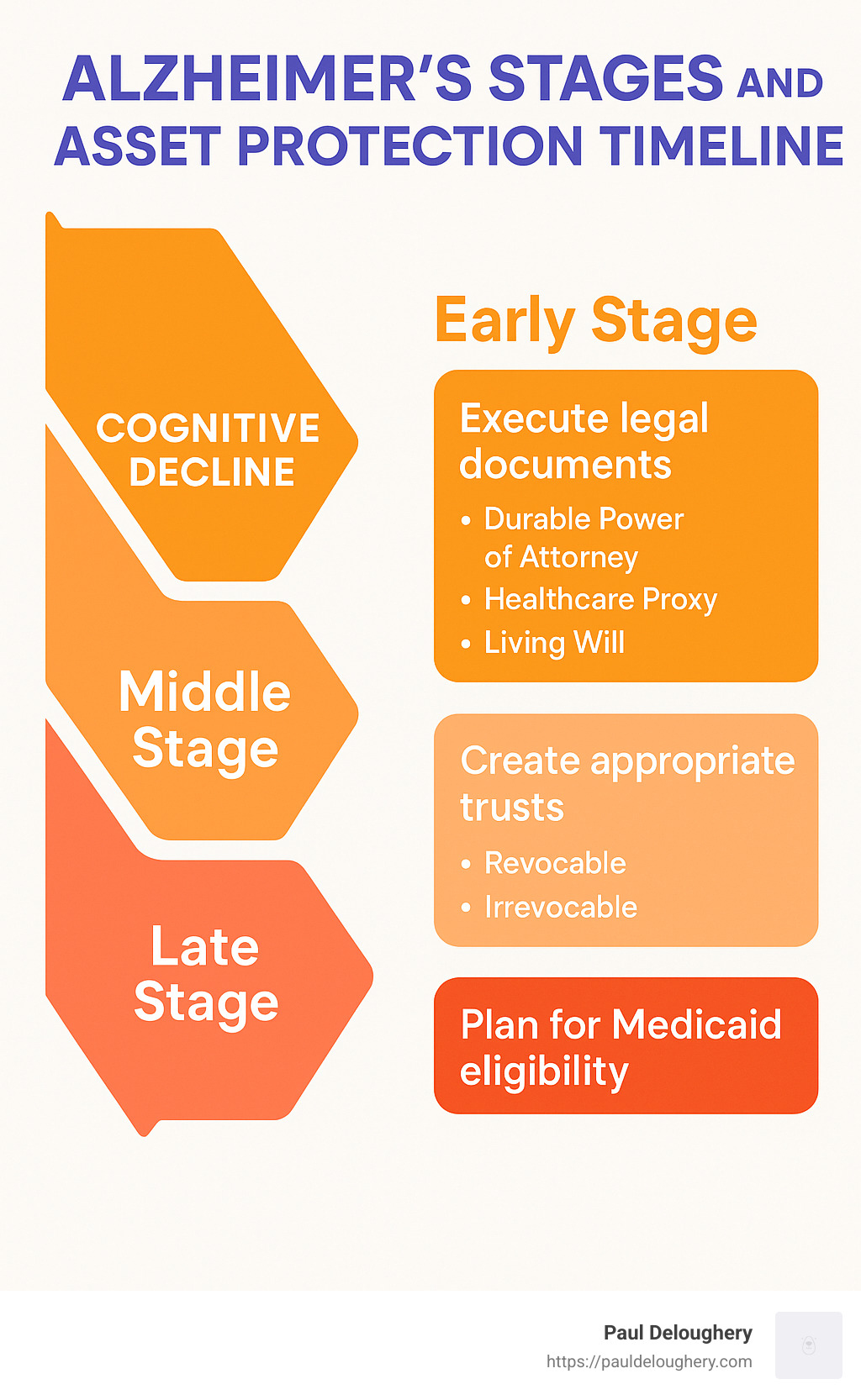

The essential steps for protecting assets alzheimer’s should begin immediately after diagnosis. First, execute crucial legal documents including a Durable Power of Attorney, Healthcare Proxy, and Living Will. Next, consider appropriate trusts – revocable trusts for management flexibility and irrevocable trusts for genuine asset protection. Don’t overlook Medicaid planning, keeping the five-year lookback period in mind. Simultaneously, organize all financial accounts and implement safeguards against exploitation through fraud alerts and regular account monitoring.

I’m Paul Deloughery, and my approach integrates elder law expertise with comprehensive estate planning. My goal is helping families fund quality care while preserving both dignity and financial resources. Together, we can create solutions that protect what matters most – your loved one’s wellbeing and your family’s future.

Alzheimer’s Impact on Money & Need for Early Action

When Alzheimer’s enters a family’s life, it doesn’t just affect memory—it fundamentally changes how someone manages their finances. The decline often starts quietly: a miscalculated tip at dinner, confusion about a bank statement, or a stack of unopened mail on the kitchen counter.

Behind these seemingly small moments lies a sobering reality. The average lifetime cost of Alzheimer’s care exceeds $400,000 per person. Families across America provide an estimated 17 billion hours of unpaid care annually, often sacrificing their own financial security in the process. With nearly 36 million people worldwide affected by Alzheimer’s and related dementias, the financial impact is staggering—over $220 billion annually in the US alone.

You might notice these early warning signs of financial difficulty:

Trouble with basic math like counting change or calculating tips. Unopened mail and bills gathering dust. Strange purchases appearing on credit card statements—sometimes the same item bought multiple times. Money mysteriously disappearing from accounts. Confusion during conversations about finances. Difficulty grasping once-familiar financial concepts.

“I know you’re highly stressed and anxious. You have every right to be. Alzheimer’s and dementia make these times for you and your family life-changing,” says experienced Elder Law Attorney Fredrick P. Niemann.

The financial strain reaches beyond direct care costs. Family caregivers often reduce work hours or leave jobs entirely, creating a double financial burden—less income coming in while expenses keep mounting. Meanwhile, as judgment fades, vulnerability to scams and financial exploitation increases dramatically.

How long can Alzheimer’s care last?

Alzheimer’s isn’t a sprint—it’s a marathon that typically stretches 10-15 years from diagnosis to end of life. This extended timeline creates unique financial challenges unlike acute illnesses with concentrated costs.

The financial journey of Alzheimer’s follows a predictable pattern of escalating expenses:

In the early stage, additional costs might seem minimal—mainly doctor visits and medications. During the middle stage, the need for supervision increases, often requiring part-time care and home modifications for safety. By the late stage, full-time care becomes necessary, either through in-home care (costing $25-$30+ per hour or $200-$360 daily for 12-16 hours) or facility care (ranging from $8,500-$13,000 monthly).

This gradual progression means families must carefully budget for years of increasing care costs while simultaneously protecting assets alzheimer’s patients need for quality care and any legacy they hope to preserve.

Protecting Assets Alzheimer’s: Why Timing Is Everything

When it comes to protecting assets alzheimer’s, the clock starts ticking immediately after diagnosis. There’s a critical window of opportunity between that first diagnosis and the eventual loss of legal capacity when protection strategies must be implemented.

Here’s why acting quickly matters so much:

Legal capacity requirements create the most urgent timeline. Most legal documents require the person signing to genuinely understand what they’re signing. As Alzheimer’s progresses, this comprehension gradually slips away, eventually making it impossible to execute valid legal documents.

Medicaid planning considerations introduce another crucial timeline. Medicaid’s five-year “lookback period” examines all financial transactions made in the five years before application. Transfers made during this window may trigger penalties and delay eligibility for benefits that could help cover care costs.

Avoiding guardianship proceedings becomes increasingly difficult with delay. Without proper legal documents in place before capacity diminishes, families often must petition courts for guardianship—an expensive, time-consuming, and unfortunately public process that could have been avoided.

For married couples, spousal protection planning becomes urgent. Early planning helps protect the healthy spouse from impoverishment while qualifying the ill spouse for benefits that can help fund care.

One elder law attorney notes, “Unlike other diseases like cancer, Alzheimer’s has no cure and is a life-ending illness 100% of the time. Alzheimer’s robs the patient’s ability to care for themselves often years before there is any effect on their physical health.”

This unique combination—certainty about the disease’s progression with uncertainty about its exact timing—makes immediate action after diagnosis not just advisable, but essential for protecting assets alzheimer’s patients have worked a lifetime to build.

Legal Toolkit: Powers, Wills & Directives

The foundation of any protecting assets alzheimer’s strategy is a comprehensive set of legal documents that ensure wishes are honored and assets are managed appropriately when decision-making capacity declines.

Power of Attorney Essentials

A Durable Power of Attorney (DPOA) is perhaps the most critical document for someone with Alzheimer’s. This legal instrument allows a designated agent to make financial decisions on behalf of the person with Alzheimer’s when they can no longer do so themselves.

Key considerations for an effective DPOA:

Agent selection: Choose someone who is trustworthy, financially responsible, and willing to serve in this capacity. This person will have significant control over financial matters.

Successor agents: Always name at least one backup agent in case your first choice cannot serve.

Scope clauses: Ensure the DPOA includes specific authorities needed for asset protection, including:

– The power to create and fund trusts

– Authority to apply for government benefits

– Ability to make gifts or transfers for Medicaid planning

– Powers to change beneficiary designations

Immediacy vs. springing: Consider whether the POA should be effective immediately (recommended for planning purposes) or only “spring” into effect upon incapacity.

Bank-specific forms: Be aware that some financial institutions require their own POA forms. Check with each institution where accounts are held.

“If what I said causes you concern, then please call an experienced Elder Law Attorney today to discuss your questions regarding a HCPOA or Living Will,” advises Fredrick P. Niemann, Esq.

More info about Asset Protection Planning

Advance Directives & Living Wills

Healthcare decisions require separate legal documents from financial matters. These documents ensure medical treatment aligns with personal values and preferences.

Healthcare Power of Attorney (HCPOA): This document appoints someone to make medical decisions when the person with Alzheimer’s cannot. The agent should understand the person’s wishes and be willing to advocate for them.

Living Will: This document specifies preferences for end-of-life care, including:

– Use of life-sustaining treatments

– Comfort care preferences

– Artificial nutrition and hydration decisions

– Organ donation wishes

POLST/MOLST Forms: Physician Orders for Life-Sustaining Treatment (POLST) or Medical Orders for Life-Sustaining Treatment (MOLST) are medical orders that travel with the patient across care settings. Unlike advance directives, these are actual medical orders signed by a physician.

In most states, two adult witnesses who are not relatives or heirs must witness a Healthcare Power of Attorney. Some states also require notarization.

Guardianship/Conservatorship Safety Net

If legal planning documents aren’t in place before capacity is lost, court-appointed guardianship or conservatorship becomes the only option.

Guardianship vs. Conservatorship:

– Guardianship: Covers decisions about living arrangements and medical care

– Conservatorship: Involves managing an individual’s assets and financial obligations

– In some jurisdictions, conservatorship is called “guardianship of the estate”

The court process typically involves:

1. Filing a petition with the court

2. Medical evaluation of the person’s capacity

3. Court hearing where evidence is presented

4. Judge’s decision on whether guardianship/conservatorship is necessary

5. Appointment of a guardian/conservator

6. Ongoing court supervision and reporting requirements

This process can cost thousands of dollars and takes weeks or months to complete. It also becomes part of the public record, unlike private planning documents.

“While many older adults fear or even resent the idea of guardianship or conservatorship, such support exists for a reason,” notes Andre L. Pennington, an attorney “wanting to do what’s right for his Family.”

Emergency petitions can be filed in crisis situations, but they still require court approval and are not immediate solutions.

Scientific research on financial incapacity and dementia

Trust Strategies & Medicaid Planning for Protecting Assets Alzheimer’s

When you’re facing Alzheimer’s, trusts become powerful allies in your financial protection plan. Think of trusts as special containers that hold your assets while providing different levels of protection and control, depending on what you need most during this challenging journey.

Revocable vs. Irrevocable Trusts

Revocable Living Trusts are like having a trusted friend hold your wallet – you can still reach in and make changes whenever you want. They’re helpful but offer limited protection for protecting assets alzheimer’s.

These trusts give you complete control while you’re capable, allow someone else to step in seamlessly if you become incapacitated, and help your family avoid the hassle of probate after you’re gone. The downside? Assets in these trusts are still considered “yours” for Medicaid purposes, meaning they’ll need to be spent on your care before Medicaid kicks in.

“You need to be able to ‘trust’ the person. (Sorry about the pun.)” as one of my estate planning colleagues likes to joke when discussing trustee selection. It’s true though – choosing the right person to manage your trust is crucial.

Irrevocable Trusts, on the other hand, are more like giving your wallet to someone else permanently. You’re essentially saying, “These assets aren’t mine anymore,” which creates stronger protection, but requires giving up control. Once established, you can’t change or revoke these trusts. The benefit? After the five-year Medicaid lookback period, these assets aren’t counted when determining your eligibility for benefits.

For married couples, I often recommend a two-step approach:

1. Retitle marital assets into the healthy spouse’s name

2. Establish a special needs trust for the spouse with Alzheimer’s

This strategy helps maximize protection while ensuring resources remain available for quality care – exactly what we want when protecting assets alzheimer’s.

More info about The Living Trust Myth

Medicaid Qualification Steps

For many families facing Alzheimer’s, Medicaid becomes the financial lifeline for long-term care. Understanding how to qualify without losing everything requires careful planning.

Medicaid has strict eligibility requirements. If you’re single, you’re limited to $2,000 in “countable resources.” Married couples can have $4,000 combined. Your home may be exempt, but states impose equity limits that vary by location. Income limitations also apply, though some states offer “income cap” trusts to help manage excess income.

The most challenging aspect of Medicaid planning is the five-year lookback period. Medicaid will examine every financial transaction you’ve made in the five years before applying. Any gifts or transfers during this period can trigger penalties that delay your eligibility – sometimes for months or even years.

That said, not all transfers cause problems. Transfers to a spouse are generally permitted. You may also be able to transfer assets to disabled children or to children who lived with you and provided care that kept you out of a nursing home for at least two years.

For married couples, there’s additional protection through the Community Spouse Resource Allowance. This allows the healthy spouse (the “community spouse”) to keep a certain amount of assets without affecting the ill spouse’s Medicaid eligibility.

“Asset protection is imperative,” as one of my elder law colleagues often emphasizes. “The ideal legal representation is an Elder Law firm with in-house estate planning counsel.” This integrated approach ensures all aspects of your plan work together seamlessly.

Scientific research on Medicaid fraud prevention

Protecting Assets Alzheimer’s: Case Study Snapshot

Let me share a real-world example that shows these strategies in action:

Margaret was an 89-year-old widow with advancing Alzheimer’s, along with arthritis, hyperlipidemia, and diabetes. She owned a modest condominium and had some savings, but was worried about running out of money for her care. She was especially concerned about preserving her condo to leave to her beloved niece who had been helping her for years.

When I first met Margaret, she was paying out-of-pocket for home care 8 hours a day, 6 days a week. At that rate, her savings would be depleted within a year. She was heartbroken at the thought of losing her home and leaving nothing for her niece.

Together, we developed a plan that transformed her situation. We prepared a Medicaid application for home care benefits, created a special trust to handle her surplus income, and carefully structured her assets to qualify for benefits while preserving her legacy.

The results were life-changing. Margaret qualified for Medicaid-funded home care for 12 hours every day, seven days a week – more care than she had before. Her condo and remaining savings were preserved for her niece’s inheritance. Most importantly, Margaret maintained her dignity and quality of life in her own home, protected against future increases in care costs.

This case demonstrates what I tell all my clients: with proper planning, you really can achieve the dual goals of funding quality care while preserving your family legacy. Protecting assets alzheimer’s isn’t just about saving money – it’s about maintaining dignity, honoring wishes, and creating peace of mind during one of life’s most challenging journeys.

Guarding Against Exploitation & Keeping Plans Current

People with Alzheimer’s disease often become magnets for financial predators. Their confusion, impaired judgment, and sometimes social isolation create the perfect storm for exploitation. As a family member or caregiver, you play a crucial role in creating a protective shield around your loved one’s finances.

Fraud-Proofing Financial Life

I’ve seen too many families find financial exploitation too late. Let’s build a fortress around your loved one’s finances before problems arise.

Start with monitoring and oversight – this doesn’t mean taking away independence overnight, but rather creating a safety net. Set up view-only online access to accounts for a trusted family member who can spot unusual activity without making changes. Having duplicate statements sent to a trusted person provides another layer of protection.

“My mom insisted she was handling everything fine,” shares Maria, whose mother had early-stage Alzheimer’s. “But when I started receiving statement copies, I noticed she’d paid the same bill three times in one month. That opened the door to a gentle conversation about help.”

Make life simpler by using direct deposit for all income and automatic bill payments for regular expenses. This reduces the chance of lost checks and forgotten bills while simplifying financial management.

When it comes to credit protection, a proactive approach works best. Place credit freezes with all three major credit bureaus to prevent anyone from opening new accounts in your loved one’s name. Consider limiting credit card access to just one card with a modest spending limit – enough for independence but with controlled risk.

The phone represents a direct line for scammers to reach vulnerable adults. Register your loved one’s number with the National Do Not Call Registry (1-888-382-1222) and invest in a good call-blocking system. Similarly, strong spam filters on email accounts can catch digital scam attempts before they reach an inbox.

Caregiver considerations matter tremendously. Always conduct background checks on anyone who will have regular access to your loved one and their home. When possible, work with licensed, bonded care agencies rather than independent providers. Keep valuable items secured and maintain a photo inventory of important possessions.

The National Institute on Aging notes, “Understandably, many older adults will resist allowing someone else to take over their financial affairs.” This resistance is natural – nobody wants to surrender independence. The key is making gradual, respectful transitions that preserve dignity while increasing protection.

If you ever suspect exploitation, don’t hesitate to contact:

– Local Adult Protective Services

– The National Elder Fraud Hotline: 1-833-372-8311

– Your local police department

More info about How to Organize Your Important Documents and Digital Information

Protecting Assets Alzheimer’s: Ongoing Review

Protecting assets alzheimer’s isn’t a “set it and forget it” process. It requires regular attention and adjustment as circumstances change – think of it like tending a garden rather than building a stone wall.

Schedule annual estate plan reviews with your attorney, especially after major life events like deaths, marriages, divorces, or significant health changes. Tax laws and state regulations evolve constantly, and your protection strategy should adapt accordingly.

“About 75% of people die without any estate planning,” I often tell my clients. “But lack of planning around incapacity—not death—is where legal gaps most often occur.” These gaps can undermine even the most thoughtful asset protection strategy.

Periodically verify that asset titles align with your overall plan. Check property deeds, vehicle titles, bank accounts, and investment accounts to ensure they’re properly titled. An incorrectly titled asset can derail your entire protection strategy.

Don’t forget about beneficiary designations – these override will provisions and need regular review. Life insurance policies, retirement accounts, and transfer-on-death accounts all pass outside your will and trust, making their designations critically important.

In our digital age, online account management has become essential. Consider using a password manager with legacy access features that allow trusted individuals to access accounts when needed. Make sure your power of attorney explicitly includes provisions for managing digital assets.

Create a “Financial Emergency Kit” containing everything a trusted helper would need if you became unavailable: account lists, advisor contacts, insurance policies, tax returns, and property records. Store this in a secure but accessible location and make sure your trusted people know where to find it.

I recently worked with a family who finded their mother had been paying for three different long-term care insurance policies for years – all because she forgot she already had coverage and salespeople took advantage of her memory lapses. Regular reviews would have caught this unnecessary expense early.

More info about 8 Reasons to Review Your Estate Plan

Conclusion

The journey through Alzheimer’s is challenging, but with proper planning, families can focus more on meaningful connection rather than financial and legal crises. Protecting assets alzheimer’s isn’t just about preserving money—it’s about honoring a lifetime of hard work while ensuring dignity and quality care throughout the progression of the disease.

When you take early, strategic action, you’re doing more than safeguarding finances—you’re creating peace of mind during an emotionally turbulent time. The comprehensive approach we’ve outlined balances immediate care needs with long-term preservation goals, addressing the unique planning challenges that Alzheimer’s creates.

I’ve seen how families who implement the right legal documents, trust strategies, and protective measures while their loved one still has capacity experience significantly less stress and conflict. They can focus on what truly matters—spending quality time together—rather than scrambling to manage financial emergencies.

Timing is everything. Acting immediately after diagnosis gives you the greatest range of options for protecting assets alzheimer’s while ensuring your loved one’s wishes are honored. The legal capacity window is precious—once it closes, your options narrow considerably.

The peace of mind that comes from knowing affairs are in order is truly invaluable. As the Alzheimer’s Association acknowledges, “It’s not an easy change when someone with Alzheimer’s needs to rely on others to act in their best interests.” But with compassionate, comprehensive planning, this transition can happen with dignity and respect.

At our firm, we understand that effective asset protection integrates legal, financial, and educational strategies to safeguard autonomy, prevent family conflicts, and ensure wealth and values endure across generations. Our holistic approach helps you:

Ensure quality care throughout every stage of the disease while protecting assets from unnecessary depletion

Qualify for benefits like Medicaid when needed while preserving a meaningful legacy for loved ones

Reduce family stress and potential conflicts by having clear plans in place

We’re here to guide you through this process with both expertise and empathy. You don’t have to steer these complex waters alone. Contact us today to begin creating your personalized asset protection plan that honors both your loved one’s care needs and their legacy wishes.